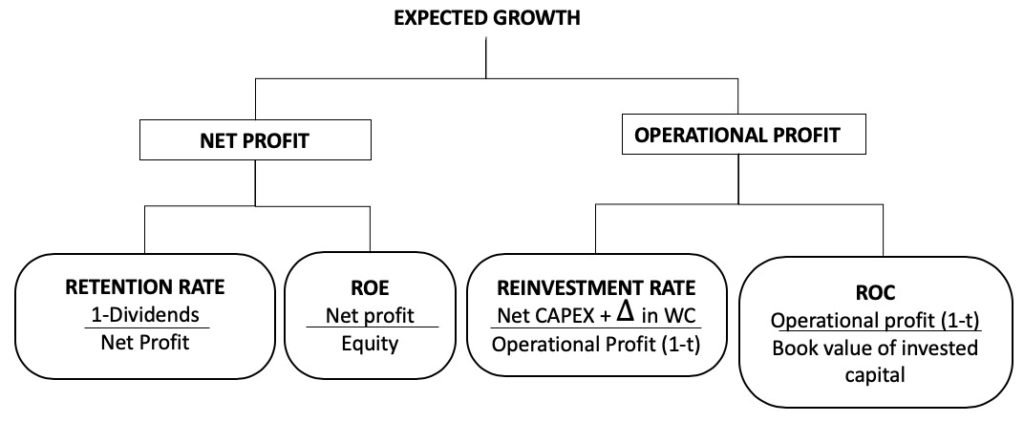

There are an important links between the reinvestment of net profits and the growth of the company. According to Professor Aswath Damodaran, the long-term profits growth rate is given by:

This can be calculated from the net profit or operating profit, for example:

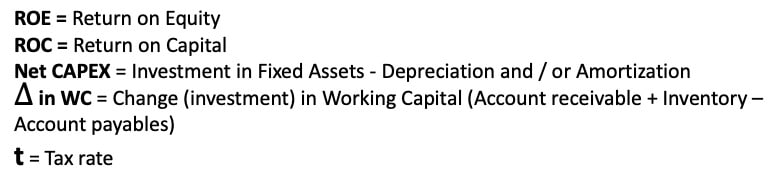

If your company generated net profits after tax of $500.000, and the return on equity (the money of partners invested in the business) is 15%, the annual growth rate should be around 10.5%. With sales of 10 million in year 1, after 5 years, you should have revenues of 14.9 million in year 5.

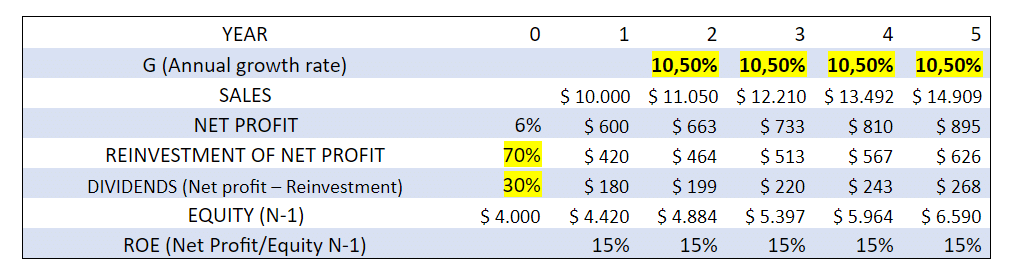

With the same margins, a company that only reinvests 20% of its net profit, will only grow at a rate of 3% and reach revenues of 11.2 million in year 5.

This is what usually happens in mature companies, which are in the second or third generation and have many partners (children, grandchildren of the funder of the company) who are dependent on the business and are permanently demanding for dividends to cover their basic expenses or lifestyle

There are many variables that can mark out or slow down growth, such as the maturity phase of the industry where the company operates, the relevance of the investments made, the political and economic environment of the country where the company operates, exchange rates, competition, etc. However, reinvestment accompanied by constant margins should generate the expected growth related to the previous formulas.

Generating 600.000 dollars of net profits, does not necessarily mean having that money available in the account to distribute to the shareholders, It is usual that, to finance the growth ot the previous year, you had to increase the accounts payables, increase the inventory and only part of this increase in working capital has been financed by your suppliers. In addition, growth may have involved reinvesting in fixed assets (CAPEX) which only left you 180 thousand dollars available to distribute.

In companies, not reinvesting enough normally means aging of productive fixed assets, low growth or loss of market share, loss of competitiveness, and in the medium and long term, it means losing profitability, competitive advantages and deterioration of business value. As if you have a car and do not do recurring maintenance, paint treatment, alignment and balancing, sooner rather than later it looks bad and starts to fail often.

My recommendation is as follows: If for any reason (e.g. fear, risk aversion, lack of motivation, lack of clarity on how to continue running the business, high need of the shareholders to receive dividends) you do not want to reinvest, you better sell the company while it is still attractive. I have several clients that have difficulties to manage their business successfully, because when they could reinvest they did not do it (they distributed many dividends) or they made mistakes in the investments they chosen, and today they do not have attractive EBITDA and/or the level of indebtedness is very high which translated of low equity value in case of a business exit.

If they had sold the business 5 years ago, they would have retired comfortably.

Conclusion: The only constant is changes, new laws are issued, there is more and more regulation, the exchange rate fluctuates, entrance of new competitors and consumer preferences vary.

If you’re not willing to reinvest and take risks to stay competitive in the complex business world that we live in, you should sell your business while it’s still attractive and take profits, if you want to stay in the game then reinvest wisely and do not stop.

Written by Simón Restrepo Barth, Investment Banker, Professor of Finance and Partner of ONEtoONE Corporate Finance, June 2019 Instagram, Linkedin, Facebook and Twitter: @restrepobarth